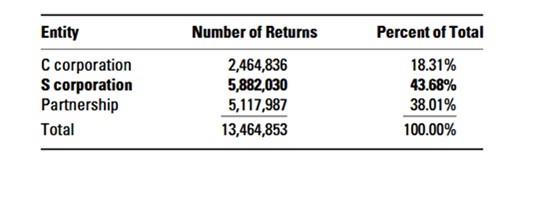

I have written in the past that S-Corps are the most popular corporate entity. Now thanks to the U of I Tax School pulling the numbers together to back it up, they account for over two-thirds of all corporations filing federal tax returns. Moreover, the number of S corporation returns exceeds the number of partnership returns.

The 2023 IRS Data Book yields the following information about the business tax returns filed in the federal government’s fiscal year 2023.

GENERAL EXEMPTION FROM INCOME TAX

S corporations are generally not subject to corporate federal income tax. The income, deductions, gains, losses, and credits of the S corporation flow through to its shareholders, via their K-1. An S corporation, however, may be subject to some entity level taxes, such as the tax on excessive passive income or on built-in gains. However, these taxes are limited to corporations that were formerly C corporations.

NONTAX CONSIDERATIONS

In addition to the previously mentioned tax considerations, there are some nontax considerations that may impact the decision on whether to elect S corporation status.

- Limited liability protection. S corporations generally provide limited liability protection to their shareholders. This means that shareholders are generally not personally responsible for the debts and liabilities of the business.

- Continuity of ownership. S corporations have perpetual existence in many states, meaning the business can continue even if ownership changes. Transfers of ownership must comply with S corporation eligibility rules to avoid terminating the S election.

- Compliance and administrative requirements. Shareholders must adhere to specific compliance and administrative requirements to maintain their S corporation status. This includes holding regular shareholder meetings and maintaining detailed records.